The Pros Of Purchasing A Home In A High-Interest Rate Environment

Have you considered purchasing a home during a period of high interest rates? The decision to purchase a home in an environment of high interest can have a significant impact on your financial health in the long run. This article discusses the pros and cons of buying a home in a high-interest rate environment, so you can make an informed decision.

An advantage of buying a home in a high-interest rate environment is that the housing market tends to cool down. Higher interest rates lead to fewer people being able to purchase homes, which can lower home prices. It is therefore possible to snag a good deal or negotiate a more favorable price with sellers.

In addition to the advantages of buying a home in a high-interest rate environment, there are also some disadvantages. One of the most notable disadvantages is the increased cost of borrowing. Mortgage payments will be higher with higher interest rates, potentially limiting your buying power.

Taking a closer look at the pros and cons of purchasing a home in a high-interest rate environment will help you better understand the implications.

Cooling Of The Housing Market

An advantage of buying a home in a high-interest rate environment is that the housing market tends to cool down. As interest rates rise, fewer people can afford to buy homes, resulting in a decrease in demand and potentially lower home prices. Therefore, you may be able to negotiate a better price with sellers.

Less Competition

There tends to be less competition among buyers in high-interest rate environments. There will likely be less competition when you make an offer because fewer people can afford homes. It can give you an advantage when negotiating the terms of the purchase or even when securing a home that might otherwise have multiple competing bids.

Favorable Investment Opportunity

Higher interest rates may increase borrowing costs, but they can also offer favorable investment opportunities. There is a strong correlation between high interest rates and high inflation. Real estate is considered a hedge against inflation, as property values tend to rise over time. If you purchase a home in a high-interest rate environment, you may be able to capitalize on future appreciation.

The Cons Of Purchasing A Home In A High-Interest Rate Environment

Increased Cost of Borrowing

The main disadvantage of buying a home in a high-interest rate environment is the higher cost of borrowing. Increasing interest rates can limit your purchasing power or stretch your budget by increasing your mortgage payments. Therefore, you may have to settle for a smaller or less desirable home, or you may need to allocate a greater portion of your income toward mortgage payments.

Affordability Challenges

Mortgages can be more difficult to qualify for for some buyers when interest rates are higher. In times of high interest rates, lenders typically have stricter borrowing criteria, making it harder to get a loan. To qualify for a mortgage, you may need a higher credit score, a larger down payment, or a lower debt-to-income ratio.

Potential Negative Equity

Buying a home at a high interest rate also carries the risk of negative equity. If home prices decline after you purchase, you may owe more on your mortgage than the house is worth. As a result, it can be challenging to sell or refinance in the future, possibly trapping you in a property of less value than what you owe.

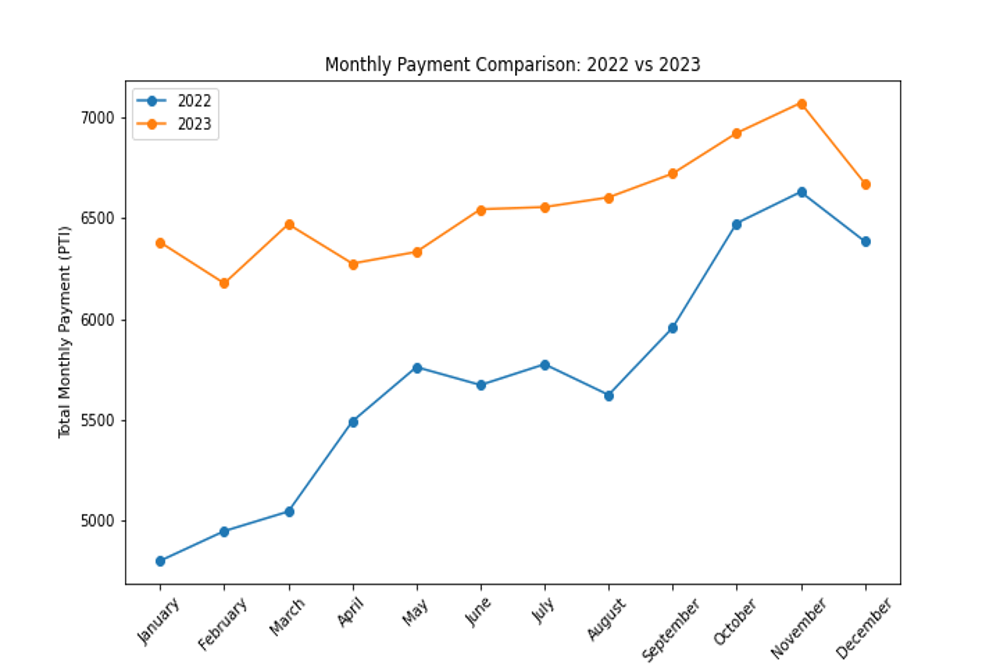

How High-Interest Rates Affect Mortgage Payments

*This chart is based off a purchase price of $1,000,000 with a 20 % down payment. Conforming 30 year loan program. All figures are average estimates. The information is provided by Shant Banosian of Guaranteed Rate.

A high interest rate directly affects mortgage payments. Interest rates are high when borrowing costs are high, so your mortgage payments are higher. As a result, you may have less purchasing power and may have a harder time affording your dream home.

Let’s look at an example to illustrate this. Imagine that you want to buy a $700,000 home for $460,000 with a 20% down payment. If your mortgage rate is 5%, your monthly payment would be $2469 per month. A rise in interest rates to 7%, however, would result in a monthly payment of about $3,060. Your budget and overall affordability may be negatively affected by this $591 difference.

Strategies For Buying A Home In A High-Interest Rate Environment

Buying a home in a high-interest rate environment may present challenges, but there are strategies you can use to navigate the market.

Improve Credit Score

In a high-interest rate environment, a higher credit score can help you secure a lower interest rate. Pay your bills on time, reduce your debt, and monitor your credit report for errors to improve your credit score.

Save For A Larger Down Payment

Higher interest rates can be offset by a larger down payment. Save more upfront to reduce the amount you need to borrow and potentially secure a more favorable loan term.

Consider Adjustable-Rate Mortgages (ARMs)

When interest rates are high, adjustable-rate mortgages (ARMs) may be worth considering. Short-term savings can be obtained from ARMs due to their lower initial interest rates. Keep in mind that rates may increase over time, and make sure you are aware of the ARM’s terms and risks.

How To Negotiate In A High-Interest Rate Environment

A high-interest rate environment requires a strategic approach to maximize your buying power. Negotiation tips that will help you succeed:

Research Market Conditions

Become familiar with the current state of the housing market, including recent sales data and trends. When negotiating with sellers, you can use this knowledge to justify a lower offer based on market conditions.

Get Pre-Approved For A Mortgage

Having a pre-approval letter from a lender demonstrates your serious intent to purchase and can give you an advantage when negotiating. Sellers are more likely to consider offers from pre-approved buyers, as financing is more likely to be secured.

Be Willing to Walk Away

In the event that the terms of a deal are not favorable, don’t be afraid to walk away. If you’re willing to walk away from a deal, you can make yourself more appealing to the seller, since it will demonstrate that you have other options and aren’t desperate to get what you want.

Alternatives To Buying In A High-Interest Rate Environment

There are alternatives to buying a home in a high-interest rate environment:

Renting

Renting might be a viable alternative for the interim if interest rates are high. In addition to allowing you to invest your money in other areas, renting provides flexibility and lower upfront costs.

Investing In Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) enable investors to invest in real estate without having to own a physical property. Diversifying your real estate investments with REITs can provide a steady income stream and capital appreciation.

Delaying The Purchase

You may want to delay your home purchase if the current high-interest rate environment does not align with your financial goals. If you wait for interest rates to fall or save for a larger down payment, you can increase your buying power and affordability in the future.

Navigating Real Estate In A High-Interest Rate Environment

The real estate market in a high-interest rate environment requires careful planning and consideration. To help you navigate the market successfully, here are some tips:

Work With A Knowledgeable Real Estate Agent

Homebuyers can benefit from valuable insight into current market conditions from a knowledgeable real estate agent. In addition to helping you find homes that fit your budget, they can also negotiate favorable terms for you.

Conduct Thorough Research

Ensure that you have done your due diligence before making an offer. Consider the neighborhood, comparable sales, and market trends before making a purchase.

Consider Long-Term Goals

Be sure to consider your long-term goals when purchasing a home in an environment of high interest rates. Is the home going to meet your needs for the foreseeable future? Is it a good investment? You can make financial decisions that align with your long-term goals if you take a long-term view.

Case Studies Of Home Purchases In A High-Interest Rate Environment

Let’s look at two real-life examples of successful home purchases in a high-interest rate environment :

Case Study 1 : The Smiths

At the peak of interest rates, the Smiths were looking to buy their first home. Taking advantage of the cooling housing market, they negotiated a lower price with the sellers. Working closely with their real estate agent, they were able to secure their dream home at a price below market value by being patient and diligent.

Case Study 2 : The Johnsons

Despite high interest rates, the Johnsons still wanted to buy a house. Despite higher borrowing costs, they diligently saved for a larger down payment. With a substantial down payment, they were able to secure a mortgage with more favorable terms, making monthly payments more manageable.

Conclusion

There are both pros and cons to buying a home in an environment with high interest rates. Despite the chance to secure a good deal or negotiate better terms, you should be sensitive to increased borrowing costs and potential affordability challenges.