Mortgages are strongly influenced by the Federal Funds Rate. How does it affect your mortgage and what does it mean? We will explore how changes in interest rates affect your monthly payments and overall financial well-being by examining the relationship between the Federal Funds Rates and mortgages.

The Federal Funds Rate is the interest rate at which banks lend funds to each other overnight to maintain their reserve requirements. As a result, it is used as a benchmark for other interest rates, including mortgages. A change in the Federal Funds Rate can impact the entire economy, influencing borrowing costs and ultimately impacting homeowners.

The Fed Funds Rate is an important factor to consider when making financial decisions.You will have a clear understanding of the dynamics at play, as well as how to manage your mortgage when interest rates change.

Understanding The Federal Reserve & Its Role In Setting Interest Rates

The Federal Reserve, often called the Fed, is the country’s central bank. Keeping prices stable and promoting sustainable economic growth are its primary objectives. Interest rates are manipulated by the Fed to achieve these goals.

The Federal Open Market Committee (FOMC), a part of the Federal Reserve, sets the Federal Funds Rate. Those on this committee are members of the Federal Reserve’s Board of Governors and presidents of regional Federal Reserve banks. Meeting regularly, they assess the economy and set interest rates.

Economic indicators such as inflation, employment rates, and GDP growth are considered by the Fed when setting the Federal Funds Rate. It is the Fed’s aim to stimulate or cool the economy by adjusting the interest rate.

What Is The Federal Funds Rate & How Is It Determined?

The Federal Funds Rate refers to the rate at which banks lend funds to each other overnight to meet reserve requirements. As a benchmark for other interest rates in the financial system, it serves as a short-term interest rate.

The Fed Funds Rate is determined by considering market conditions and monetary policy goals. As part of the FOMC’s process to determine whether there needs to be an interest rate change, the economic data and market indicators are evaluated.

When the Federal Reserve changes its Federal Funds Rate, it announces the new target rate. In addition to impacting mortgage rates, this announcement has a cascading effect on the entire financial system.

The Relationship Between the Federal Funds Rate & Mortgages

Federal Funds Rates and mortgage rates are not directly related but interconnected. Several factors affect mortgage rates, including the economy, mortgage demand, and investor expectations. In determining mortgage rates, lenders use the Fed Funds Rate as a reference point.

It becomes more expensive for banks to borrow money when the Fed increases the Federal Funds Rate. To compensate for the higher borrowing costs, lenders may increase mortgage interest rates. Conversely, when the Fed lowers the Funds Rate, borrowing becomes cheaper for banks, resulting in lower mortgage rates.

Mortgage rates are also influenced by other factors, such as the 10-year Treasury yield, which is used as a benchmark for long-term rates. Furthermore, lenders consider factors such as creditworthiness, loan term, and down payment when setting mortgage rates for an individual.

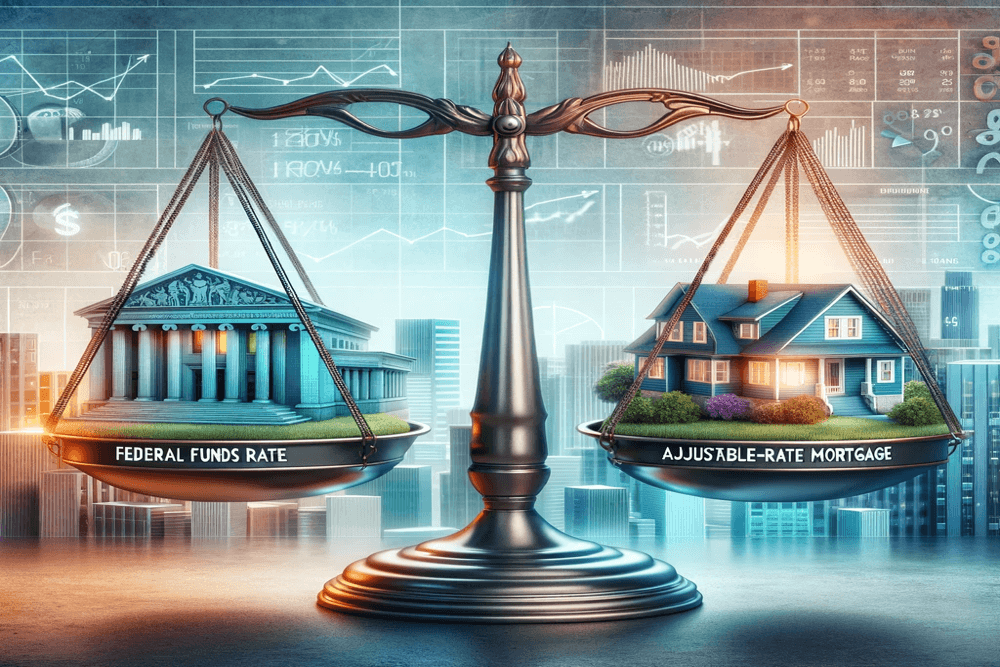

How The Federal Funds Rate Affects Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) have interest rates that fluctuate over time. The interest rate on these mortgages usually adjusts periodically based on a benchmark index, such as the London Interbank Offered Rate (LIBOR) or the U.S. Prime Rate.

An adjustable-rate mortgage’s interest rate is typically tied to an index plus a margin. Changes in the Funds Rate can indirectly affect the index to which ARMs are tied. Due to changes in the interest rate on an adjustable-rate mortgage, monthly mortgage payments can be adjusted.

A rising Federal Funds Rate may increase the index to which an ARM is linked, leading to higher mortgage rates during the adjustment period. Conversely, when the Funds Rate decreases, the index may decrease, resulting in a lower mortgage rate.

A borrower with an adjustable-rate mortgage should carefully consider how changes in the Federal Funds Rate might affect their mortgage payment. To assess the potential risks and benefits of adjustable-rate mortgages, it is crucial to understand the terms and conditions of the mortgage agreement.

Fixed-Rate Mortgages & The Impact Of The Fed Funds Rate

In contrast to adjustable-rate mortgages, fixed-rate mortgages have an interest rate that remains constant throughout the loan term. In a fixed-rate mortgage, the interest rate is determined at the time of borrowing and is not affected by changes in the Federal Funds Rate.

Over the course of the loan, homeowners can accurately predict their monthly mortgage payments because of this stability. In fixed-rate mortgages, the Fed Funds Rate does not directly impact the interest rates, making them a secure and stable investment.

During periods of low federal funds rates, fixed-rate mortgages may have higher initial interest rates than adjustable-rate mortgages. When choosing between fixed-rate and adjustable-rate mortgages, borrowers should carefully consider their financial situation and long-term goals.

Historical Trends : The Fed Funds Rate & Mortgage Rates Over Time

There has historically been a correlation between mortgage rates and the Federal Funds Rate. Mortgage rates tend to rise when the Federal Funds Rate rises. In contrast, mortgage rates tend to decrease when the Funds Rate decreases.

This correlation is not always consistent, and other factors can affect mortgage rates as well. Mortgage rates can be affected by economic conditions, inflation expectations, and market demand.

Historical trends can provide insight into the relationship between the Federal Funds Rate and mortgage rates. An examination of past patterns can help borrowers determine how changes in interest rates may affect their monthly mortgage payments.

The Federal Funds Rate Factors That Impact Mortgages

It’s important to note that the Federal Funds Rate is not the only factor that determines mortgage rates. A number of other factors can affect the Fed Funds Rate’s impact on mortgages.

Inflation is one of these factors. During times of high inflation, mortgage lenders may raise mortgage rates to compensate for money’s loss of purchasing power. In contrast, low inflation rates can lead to lower mortgage rates.

In addition, mortgage rates can be influenced by the demand for mortgages on the market. Rates may be raised by lenders during periods of high demand in order to manage capacity and reduce risks. In contrast, lenders may lower rates during periods of low demand to attract borrowers.

Another important factor is creditworthiness. Mortgage rates are more likely to be lower for borrowers with excellent credit scores and strong financial profiles, regardless of changes in the Federal Funds Rate.

How To Navigate Mortgage Decisions In A Changing Interest Rate Environment

In an interest rate environment that is constantly changing, mortgage decisions require careful consideration of personal circumstances as well as long-term goals. To help you make informed decisions, here are some tips:

Step One: Keep an eye on economic indicators and Federal Reserve announcements

You can anticipate potential changes in mortgage rates by understanding the factors that influence interest rates.

Step Two : Determine your financial situation

Take into account your income, expenses, and financial goals. Identify your risk tolerance and needs in determining whether a fixed-rate or adjustable-rate mortgage is right for you.

Step Three: Get connected with mortgage professionals

You should speak with a mortgage professional who can provide insight into the mortgage market and help you understand how changing interest rates might affect you.

Step Four: Plan for potential rate changes

Consider whether you are able to handle the increased mortgage payments if you opt for an adjustable-rate mortgage. Consider various scenarios of rising interest rates as you evaluate your budget.

Step Five: Refinance when beneficial

When interest rates are low, consider refinancing your mortgage. A refinance could potentially lower your monthly payments or allow you to pay off your mortgage more quickly.

You can make the right mortgage decisions, regardless of the interest rate environment, by staying informed, assessing your financial situation, seeking professional advice, and planning ahead.

Conclusion | The Fed Funds Rate & Mortgage Implications

A clear understanding of the relationship between the Federal Funds Rate and your mortgage is crucial to making informed financial decisions. Despite not directly affecting mortgage rates, the Fed Funds Rate serves as an important reference point.

Understanding economic indicators, historical trends, and market conditions can allow you to anticipate possible changes in mortgage rates. Whether you choose an adjustable-rate or fixed-rate mortgage depends on your financial situation and long-term goals.

Staying informed, analyzing interest rates carefully, and consulting professionals are all important in a changing interest rate environment. You can then make informed decisions aligned with your financial goals and ensure that your mortgage remains manageable and beneficial for you.